maryland student loan tax credit 2020

Amount of wages and salaries disallowed as a deduction due to the work opportunity credit. Maryland taxpayers who have.

More Companies Are Wooing Workers By Paying Off Student Debt Money

Complete the Student Loan Debt Relief Tax Credit application.

. ANNAPOLIS MDGovernor Larry Hogan and Maryland Higher Education. Yes it is. The tax credit is claimed on the recipients Maryland income tax return when they file their Maryland taxes.

If the credit is more than the taxes owed they will receive a tax refund for the. Student Loan Debt Relief Tax Credit Program. Governor Hogan Announces 2019 Award of 9 Million in Tax Credits for Student Loan Debt.

Ad Apply for Income-Based Student Loan Forgiveness if You Make Between 30k - 200k Per Year. From July 1 2022 through September 15 2022. Additional prioritization criteria are set forth in 10-740 of the Tax-General Article of the Annotated Code of Maryland and in the implementing regulations.

The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education Commission. MHEC Student Loan Debt Relief Tax Credit Program 2019. Amount of student loan indebtedness discharged Attach notice.

To anyone who applied for the MHEC student loan debt relief tax credit for 2020 you may want to check your applicationaward status on the Maryland OneStop portal to see if you were. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for.

The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education Commission. The purpose of the Student Loan Debt Relief Tax Credit is to assist Maryland Tax Payers who have incurred a. Tax Year 2020 Only.

Plan Long-Term with Our Multi-Year Approval Loan Options. Indicate if you have applied for a Maryland. Ad Apply for a Loan with a Trusted Lender.

Instructions are at the end of this application. ANNAPOLIS MDGovernor Larry Hogan and Maryland Higher Education Commission MHEC Secretary Dr. Will have maintained residency within the state of Maryland for the 2020.

Ad Apply for a Loan with a Trusted Lender. From the list of Maryland credits select the topic Student Loan Debt Relief Credit You will be asked to enter the amount on the certification from the Maryland. Complete Your App Today.

If the credit is more than the taxes you would otherwise owe you will receive a. Multi-Year Approval Options Available. Maryland taxpayers who have.

The tax credit is claimed on the recipients Maryland income tax return when they file their Maryland taxes. Federal Student Loan Forgiveness Programs are Available under the 2010 William D Ford Act. Complete Your App Today.

From July 1 2022 through September 15 2022. The new stimulus bill signed on December 21 2020 extends the ability for employers to make tax-free student loan repayment contributions for employees until 2025. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are eligible to apply for the.

Student Loan Debt Relief Tax Credit for Tax Year 2020. If the credit is more than the taxes owed they will receive a tax refund. Plan Long-Term with Our Multi-Year Approval Loan Options.

Fielder announced the awarding of nearly 9. Multi-Year Approval Options Available. Complete the Student Loan Debt Relief Tax Credit application.

Will have maintained residency within the state of Maryland for the 2020 tax year Have incurred 20000 or more in student loan. Student Loan Debt Relief Tax Credit Application. The Maryland Higher Education Commissionmay request additional.

If you need assistance with your student loan servicer contact the Student Loan Ombudsman in our Office by email at studentloanombudsmanmarylandgov or by phone at.

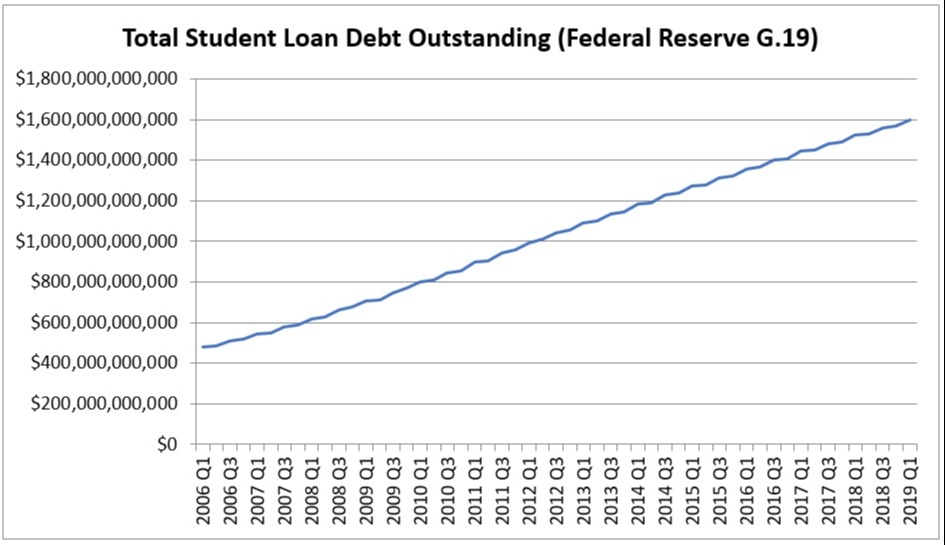

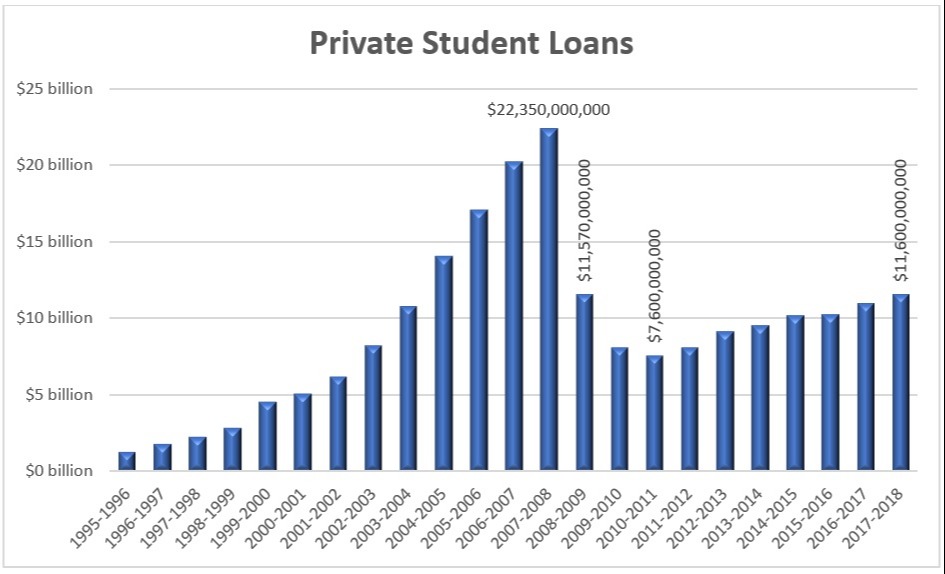

Total Us Student Loan Debt Outstanding Saving For College Blog

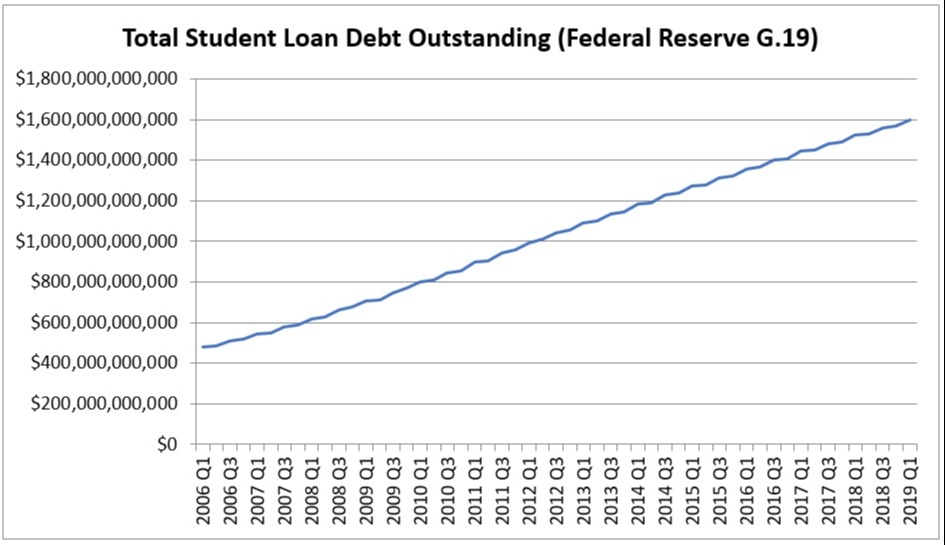

Student Debt Has Increased Sevenfold Over The Last Couple Decades Here S Why

Student Loan Refinance Pros And Cons White Coat Investor

What Are The Pros And Cons Of Student Loan Forgiveness

Learn How The Student Loan Interest Deduction Works

What Are The Pros And Cons Of Student Loan Forgiveness

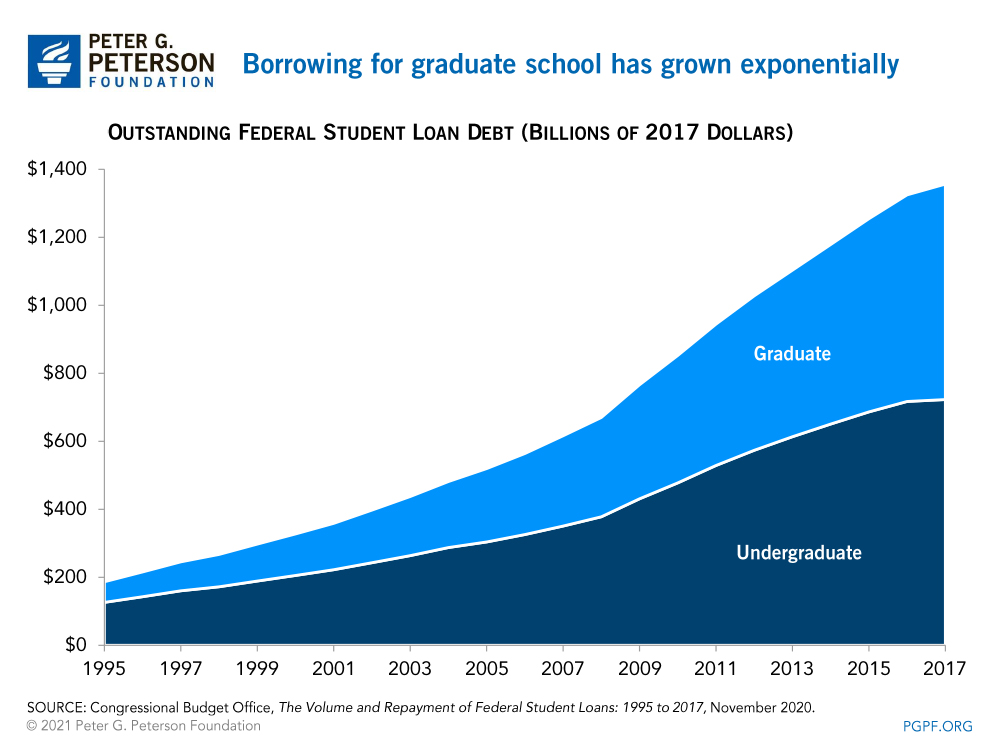

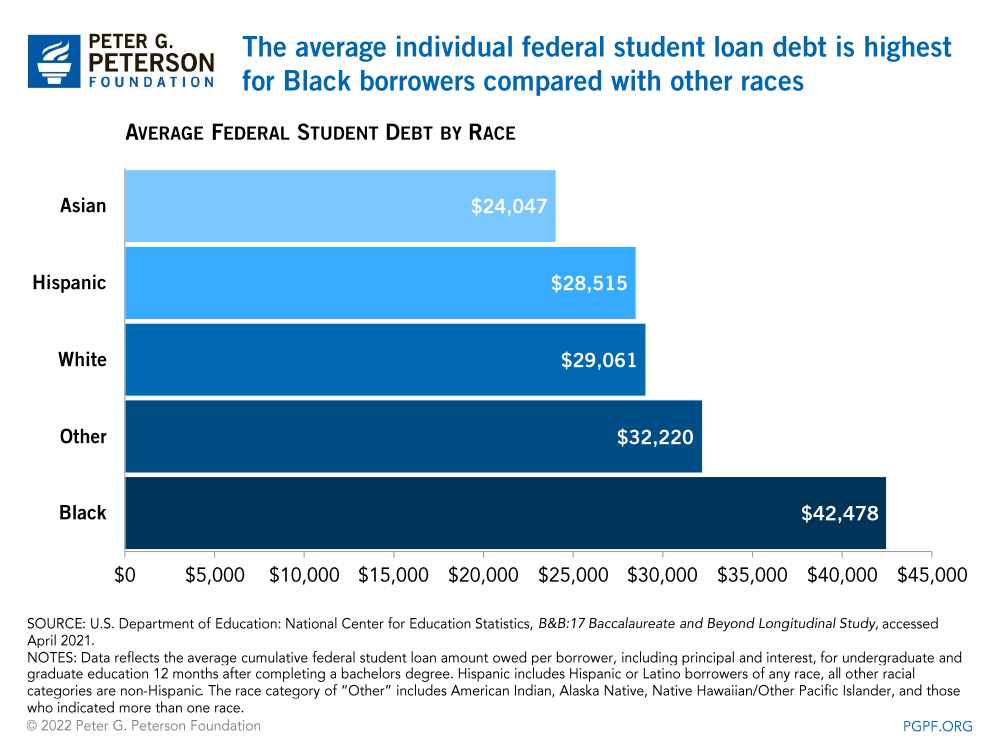

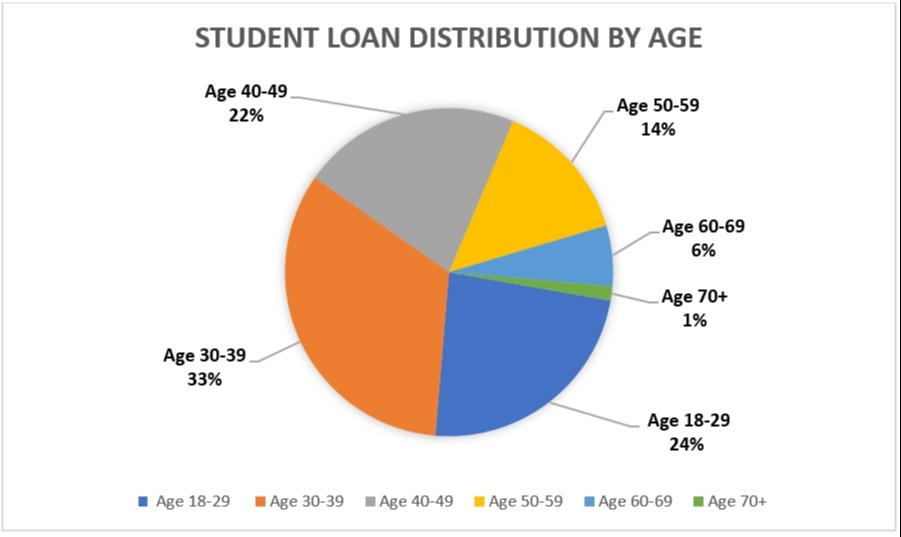

Who Owes The Most Student Loan Debt

Total Us Student Loan Debt Outstanding Saving For College Blog

Learn How The Student Loan Interest Deduction Works

Student Loans Taxes Deductions Filing Returns And Retirement White Coat Investor

20 Companies That Help Employees Pay Off Their Student Loans Student Loan Hero

Student Loan Forgiveness Statistics 2022 Pslf Data

Statistics Concerning Student Loan And Borrower Characteristics

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Current Student Loans News For The Week Of Feb 14 2022 Bankrate

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Are Student Loans Bad Or Good Debt Here S What You Need To Know Student Loan Hero

Student Loans Taxes Deductions Filing Returns And Retirement White Coat Investor

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero